EUR/USD Prepares for Volatility Ahead of Fed Meeting and Weak PMI Data

The EUR/USD pair is poised for a critical week as traders prepare for the Federal Reserve's highly anticipated monetary policy decision on Wednesday. The primary concern is whether the Federal Reserve will reduce the benchmark rate from 4.75% to 4.5% by 25 basis points. This decision, in conjunction with the Eurozone's poor economic data, establishes the foundation for substantial volatility in the currency pair.

EUR/USD Scenarios for the Federal Reserve Meeting

The EUR/USD pair will be significantly affected by the Federal Reserve's decision and the attendant commentary, with three potential outcomes:

A Hawkish Message and No Rate Cut: The U.S. dollar is expected to strengthen considerably, resulting in a precipitous decline in the EUR/USD pair, if the Fed chooses to maintain unchanged rates. This scenario would emphasise the Federal Reserve's ongoing efforts to combat inflation, thereby strengthening the dollar index and exerting downward pressure on the Euro.

Hawkish Commentary, Rate reduction: The most probable result is a 25-basis-point rate reduction in conjunction with a hawkish tone. Although this scenario could result in a partial recovery for the EUR/USD, the positive potential would be restricted due to the hawkish commentary, which would bolster the dollar's resilience.

Dovish Commentary and Rate Cut: The Euro may experience substantial strength in the event that the Federal Reserve reduces rates and issues a dovish message, which is the least probable scenario. This would erode the dollar index and create an advantageous environment for the EUR/USD to increase. Nevertheless, this result seems unlikely in light of the most recent inflation data.

Soft Eurozone PMI Data Increases Pressure

Traders are also analysing the most recent manufacturing and services PMI data from the Eurozone, which was published earlier today, in anticipation of the Fed meeting. The data presents a bleak outlook for the Eurozone economy, as numerous indicators continue to fall below the 50-point contraction threshold. Particularly:

French Flash Manufacturing PMI: 41.9 (previously: 43.2)

French Flash Services PMI: 48.2 (previously: 46.9)

German Flash Manufacturing PMI: 42.5 (previously: 43.1)

German Flash Services PMI: 51.0 (previously: 49.5)

The data underscores the ongoing challenges faced by the manufacturing sector, notably in France and Germany, where manufacturing PMIs remain in the depths of contraction. The French manufacturing PMI experienced an additional decline to 41.9, indicating a significant decline in industrial activity. The manufacturing PMI of 42.5 was reported by Germany, which is frequently considered the economic motor of the Eurozone, thereby extending its contraction trend.

Despite the fact that the German services PMI has managed to enter expansion territory at 51.0, the Eurozone economy's broader outlook remains of concern. Although the services sector in France has improved to 48.2, it continues to contract, suggesting that the economic momentum is fragile.

Policy Restrictions of the European Central Bank

The narrative that the European Central Bank (ECB) is confronted with substantial obstacles is further confirmed by the weakness of the PMI data. The European Central Bank is under increasing pressure to take additional measures to stimulate development in response to the weakening of economic activity in critical sectors. Nevertheless, the ECB is constrained by the high inflation levels, as aggressive policy easing may rekindle price pressures.

The EUR/USD pair is subject to additional headwinds as a result of the Fed's policy divergence. The Euro is at a disadvantage and is susceptible to further weakness as the ECB's options remain constrained, despite the fact that the Fed is edging closer to a rate cut.

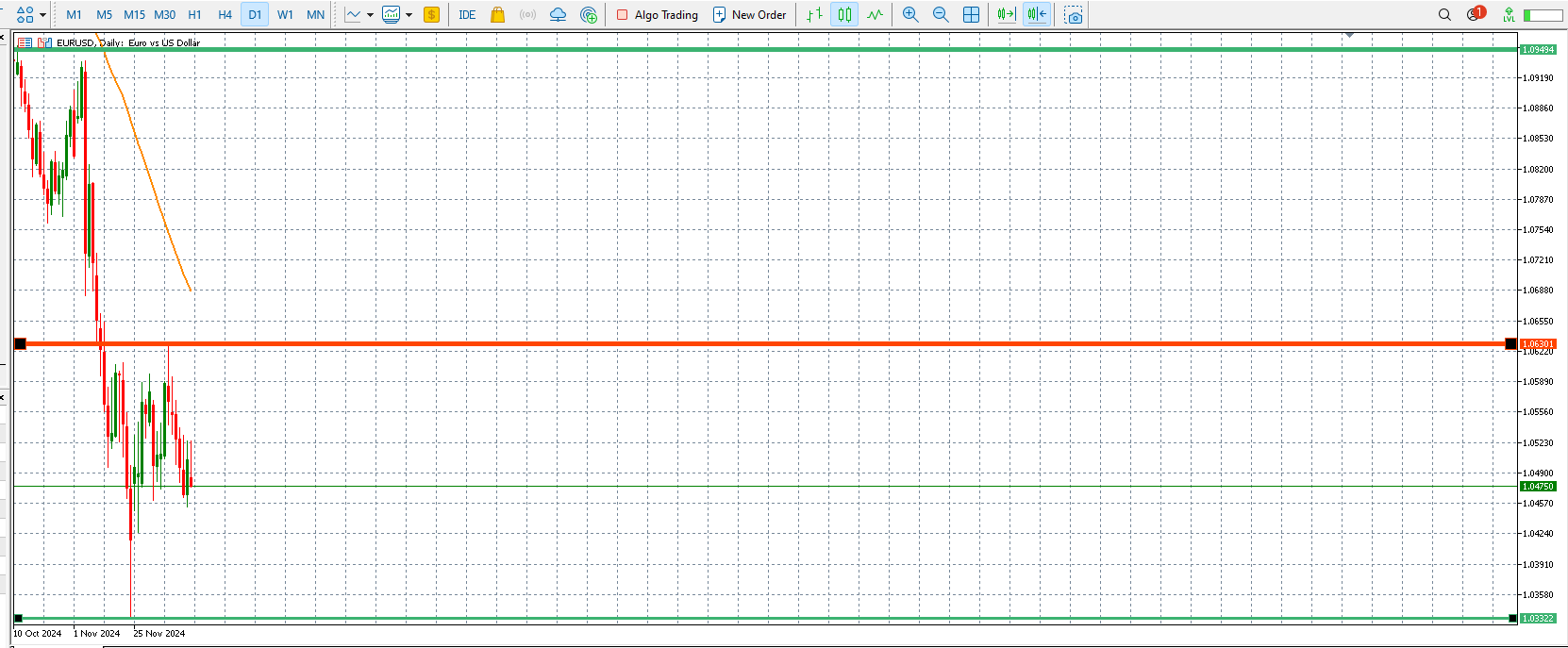

The below chart shows the important support and resistance levels for the Euro/USD

Forex Trading chart by XTB

In summary, the EUR/USD is experiencing a critical week.

The EUR/USD pair is still subject to two significant catalysts as the market approaches the Fed meeting on Wednesday: the Fed's rate decision and the lacklustre Eurozone PMI data. The short-term trajectory of the pair will be determined by the Fed's actions and tone, as the Euro is already under pressure as a result of subpar economic indicators and restricted ECB flexibility. The EUR/USD could experience a significant decline if the Fed adopts a hawkish stance, while any dovish signals, despite their rarity, could provide some respite. As these significant events transpire, traders should anticipate increased volatility.