Snap-on Stock Outlook: Is Wall Street Bullish or Bearish?

/Snap-on%2C%20Inc_tool%20truck-by%20John%20Hanson%20Pye%20via%20Shutterstock.jpg)

With a market cap of $17 billion, Snap-on Incorporated (SNA) is a global leader in the innovation, manufacturing, and marketing of tools, equipment, diagnostics, and system solutions for professional users. It serves diverse industries, including automotive, aerospace, government, and power generation, through its various business segments and multi-channel sales model.

Shares of the Kenosha, Wisconsin-based company have outpaced the broader market over the past 52 weeks. SNA has soared 20.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 11.6%. However, shares of Snap-on are down nearly 4% on a YTD basis, lagging behind SPX’s marginal gain.

Focusing more closely, the tool and diagnostic equipment maker has outperformed the Industrial Select Sector SPDR Fund’s (XLI) 15.2% return over the past 52 weeks.

Shares of Snap-on tumbled 8% on Apr. 17 due to disappointing Q1 2025 results, with EPS of $4.51 and net sales of $1.1 billion, both missing the consensus estimates. The Tools Group segment was particularly weak, with sales down 7.4% to $462.9 million, well below the projection, driven by reduced U.S. technician purchases of financed products.

For the fiscal year ending in December 2025, analysts expect SNA’s EPS to decline 2.2% year-over-year to $18.76. The company's earnings surprise history is mixed. It topped the consensus estimates in two of the last four quarters while missing on two other occasions.

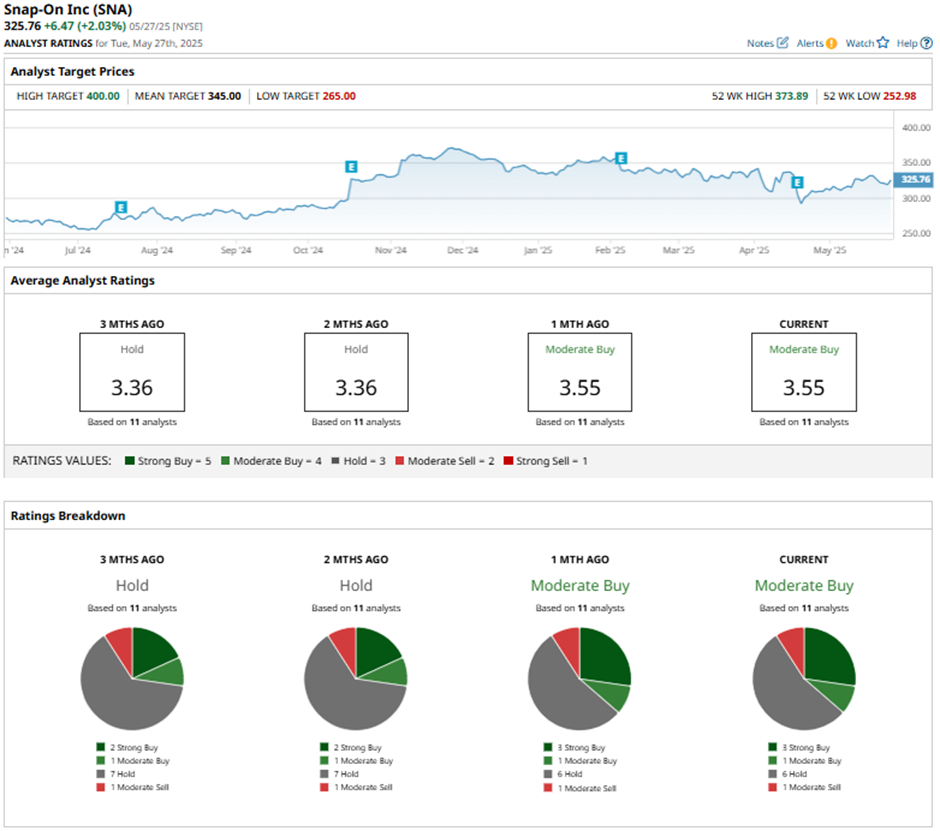

Among the 11 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on three “Strong Buy” ratings, one “Moderate Buy,” six “Holds,” and one “Moderate Sell.”

This configuration is slightly more bullish than three months ago, with two “Strong Buy” ratings on the stock.

On Apr. 21, Roth Capital lowered its price target on Snap-on to $365 while maintaining a “Buy” rating.

As of writing, SNA is trading below the mean price target of $345. The Street-high price target of $400 implies a potential upside of 22.8% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.