Moderna Stock: Is Wall Street Bullish or Bearish?

/Moderna%20Inc%20meds-by%20Ascannio%20via%20Shutterstock.jpg)

With a market cap of $10.7 billion, Moderna, Inc. (MRNA) is a biotechnology company specializing in the development of messenger RNA (mRNA) medicines. The company offers a broad pipeline that includes respiratory and latent virus vaccines, oncology therapeutics, and rare disease treatments, and has strategic collaborations with major global partners.

Shares of the Cambridge, Massachusetts-based company have significantly underperformed the broader market over the past 52 weeks. MRNA stock has tumbled 67.2% over this time frame, while the broader S&P 500 Index ($SPX) has gained 21.5%. Moreover, Moderna's shares have plunged 33.9% on a YTD basis, compared to SPX's 7.1% rise.

Looking closer, the biotechnology company stock has also lagged behind the Health Care Select Sector SPDR Fund's (XLV) 9.8% decrease over the past 52 weeks.

Despite reporting a better-than-expected Q2 2025 loss of $2.13 per share and revenue of $142 million, Moderna shares dipped 6.6% on Aug. 1 due to trimmed 2025 revenue guidance of $1.5 billion - $2.2 billion. The revision stemmed from deferred UK COVID vaccine deliveries and highlighted broader concerns, including a 41% year-over-year revenue drop, slumping COVID demand, slower-than-expected RSV rollout, and regulatory delays. Additionally, the company faces mounting pressure to cut costs, targeting a $400 million reduction in 2025, after pandemic-era profits faded.

For the fiscal year ending in December 2025, analysts expect Moderna’s loss per share to decline 13.6% year-over-year to $10.08. However, the company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

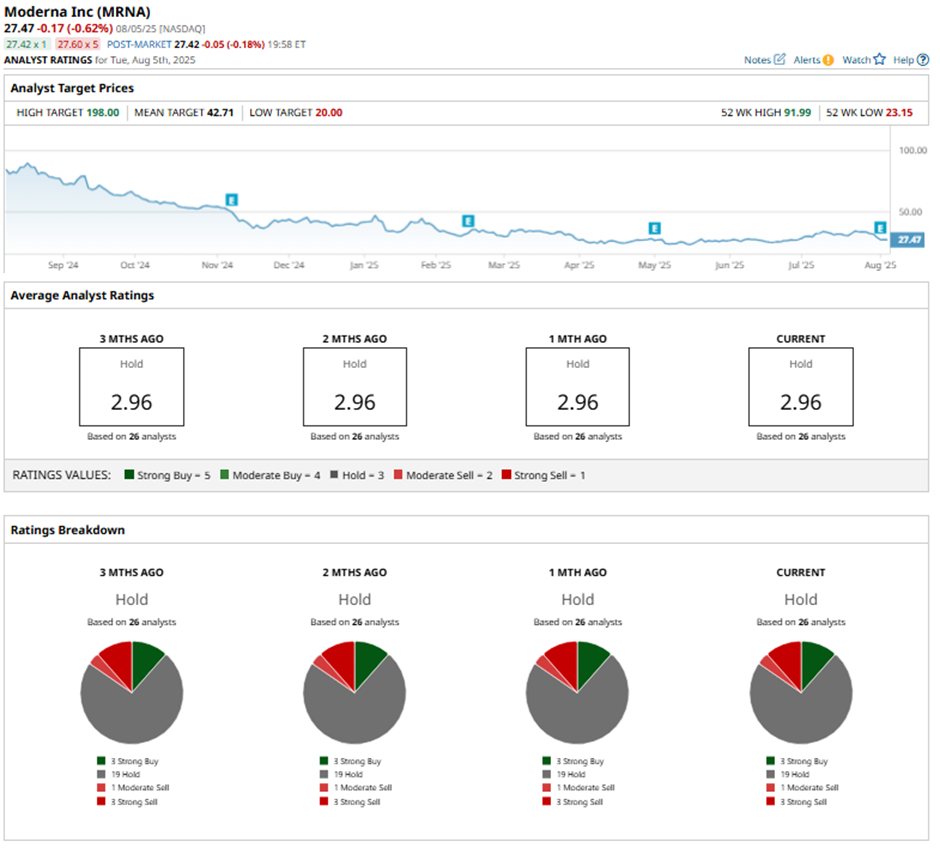

Among the 26 analysts covering the stock, the consensus rating is a “Hold.” That’s based on three “Strong Buy” ratings, 19 “Holds,” one “Moderate Sell,” and three “Strong Sells.”

On Aug. 4, BofA analyst Tim Anderson lowered Moderna’s price target to $24 and maintained an “Underperform” rating.

As of writing, the stock is trading below the mean price target of $42.71. The Street-high price target of $198 implies a significant potential upside from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.