The Bullish Cattle Stampede Rumbles On. Here’s What to Watch Next After Record Cattle Highs.

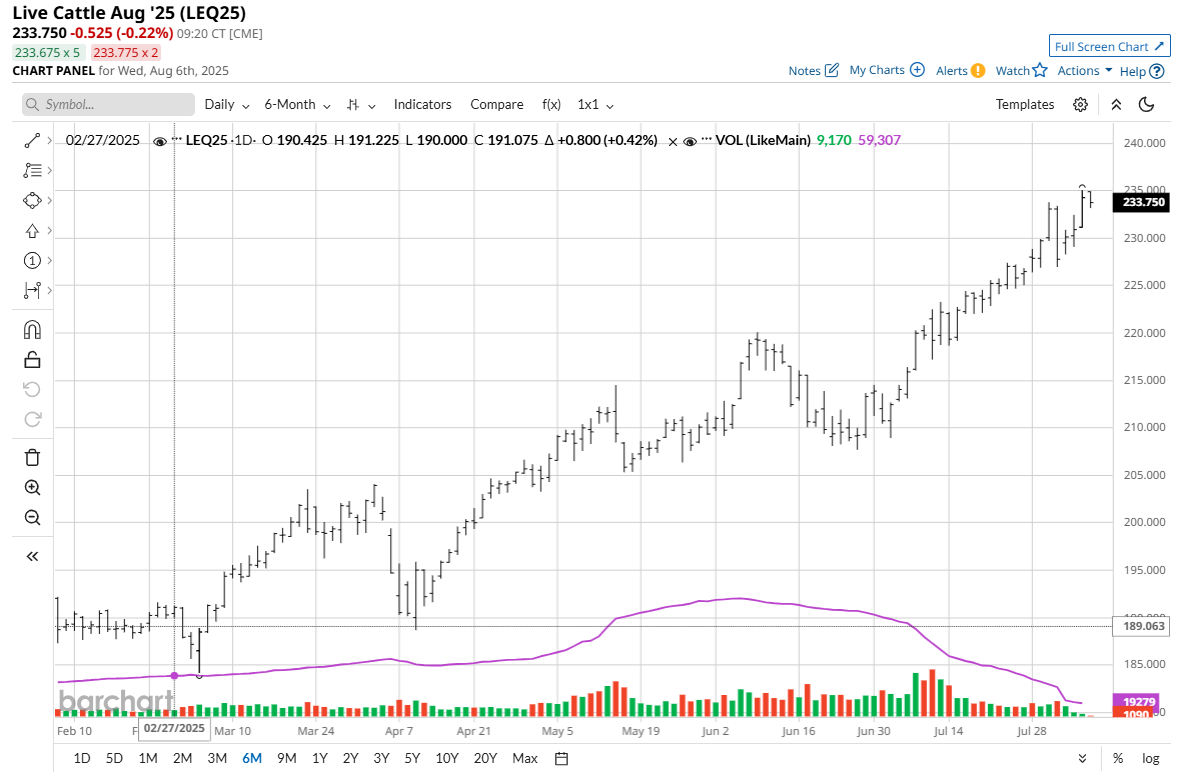

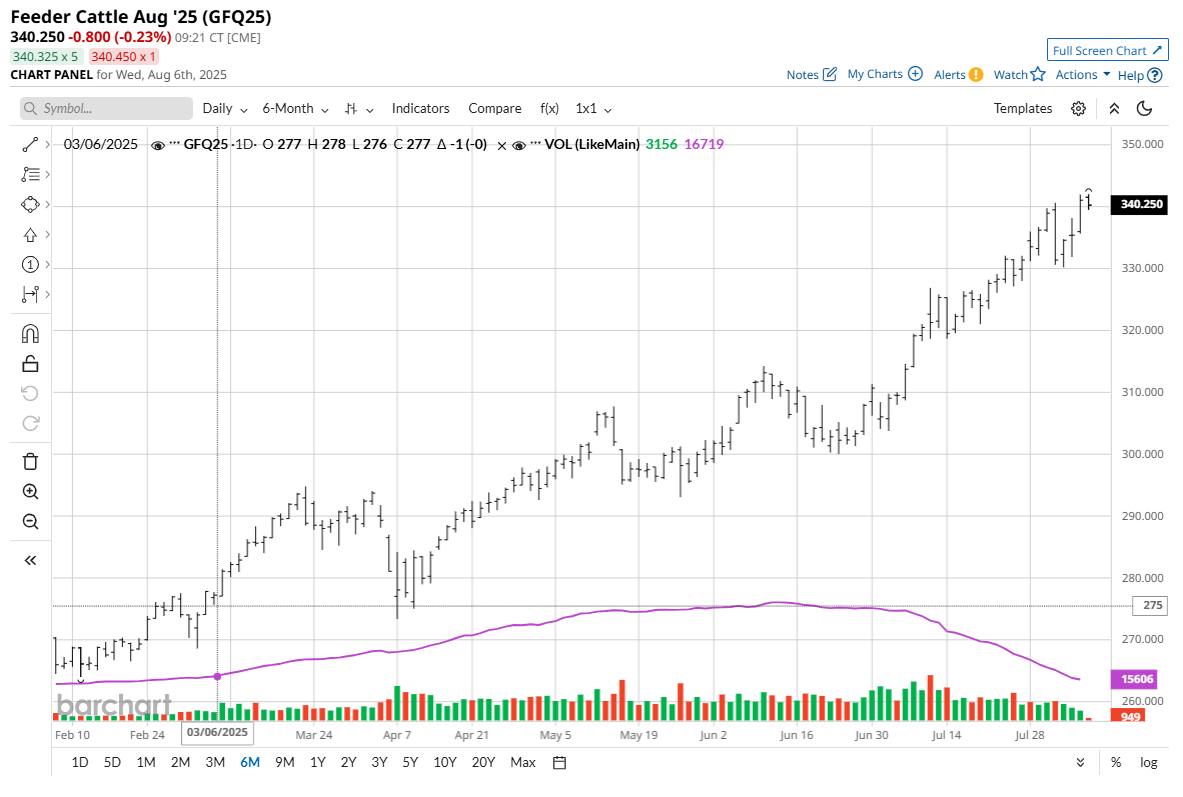

August live cattle futures (LEQ25) scored a contract and record high of $235.025 a hundredweight on Tuesday, Aug. 5. August feeder cattle futures (GFQ25) also hit a contract and record high today of $341.975 a hundredweight. Cattle futures’ record-setting bull run is being fueled by strong cash cattle and beef market fundamentals. Technical charts also remain solidly bullish for live and feeder cattle futures markets. August live cattle and August feeders remain in strong price uptrends on the daily charts, with no strong, early chart clues to suggest price tops are imminent. That means the path of least resistance for cattle futures prices will remain sideways to higher until a significantly bearish technical clue arises.

Indeed, the price strength in cattle futures is likely to continue until the cash and beef markets signal market tops are in place. As of this writing on Wednesday morning, the cash cattle trade has been light so far this week, with an average price fetched of $240.00, according to the USDA. The USDA reported on Monday, Aug. 4 that the average cash cattle trading price last week was a record high $243.17. Wholesale boxed beef prices on Tuesday saw Choice-grade cutout value up another $4.15 to $369.94, while Select-grade gained $4.35 to $345.94.

Dating back to price action last year in the live and feeder cattle futures markets, the bulls continue to show keen resilience on any price setbacks. Bullish traders continue to step in to successfully buy the dips, while the would-be speculative top-pickers have had their fingers burned time and time again. When futures markets are in rare bullish territory, they are there for a reason. Top-pickers need to be precise on their timing but are wrong more times than they are right in futures trading.

However, cattle market traders are taking note that the outdoor grilling season has passed its peak, and with it, seasonal cattle slaughter levels tend to start rising. With cattle futures prices at recent record highs and with beef packers seeing their cutting margins presently in the red, the beef packers may be reluctant to raise their bids for cash cattle in such conditions.

Still, the latest USDA cattle-on-feed report, released in late July, leaned price-friendly for cattle markets. The report showed U.S. cattle and calves on feed for the slaughter market in the U.S. for feedlots with capacity of 1,000 or more head totaled 11.1 million head on July 1. That’s 2% below July 1, 2024. The inventory included 6.88 million steers and steer calves, up 1% from the previous year. Heifers and heifer calves accounted for 4.24 million head, down 5% from 2024. Cattle placed in feedlots during June totaled 1.44 million head, 8% below 2024. Net placements were 1.39 million head. Marketings of fed cattle during June totaled 1.71 million head, 4% below 2024. Marketings were the lowest for June since the cattle-on-feed series began in 1996.

From a macroeconomic perspective, recent U.S. economic data has been a mixed bag for the cattle futures markets, as a good second-quarter U.S. gross domestic product report last week was offset by a surprisingly weak July jobs report out last Friday. How the U.S. economic data report pendulum swings in the next few months will play an important role in consumer confidence and in turn consumer demand for beef at the meat counter. It’s important to point out that history shows the months of September and October can be unkind to the U.S. stock market, and the stock market has a significant impact on consumer confidence.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.