Do Wall Street Analysts Like Cardinal Health Stock?

/Cardinal%20Health%2C%20Inc_%20logo%20on%20building%20by-%20JHVEPhoto%20via%20Shutterstock.jpg)

With a market cap of $37.4 billion, Cardinal Health, Inc. (CAH) is a leading Ohio-based healthcare services and products company specializing in pharmaceutical distribution and medical supply manufacturing. It serves over 100,000 locations globally, serving hospitals, pharmacies, and healthcare providers.

CAH shares have delivered an impressive rally, soaring 53.9% over the past 52 weeks and are up 29.7% in 2025, outpacing the S&P 500 Index’s ($SPX) 21.9% gains over the past year and a 7.8% surge on a YTD basis.

Zooming in further, CAH has also surpassed the SPDR S&P Health Care Services ETF’s (XHS) 5.2% fall over the past year and 1.5% dip in 2025.

On Jul. 30, Cardinal’s shares rose marginally after the company announced the expansion of its Equity Rx program, aimed at supporting individuals in Ohio and beyond who cannot afford prescription medications. Initially launched as a pilot in Ohio in 2023 through a partnership with the Cardinal Health Foundation, the Charitable Healthcare Network, and St. Vincent de Paul Charitable Pharmacy, the initiative has now received a total investment of $5 million from the Foundation.

For the year that ended in June 2025, analysts expect Cardinal’s earnings to grow 8.6% year-over-year to $8.18 per share. Furthermore, the company has a solid earnings surprise history. It surpassed the Street’s bottom-line expectations in each of the past four quarters.

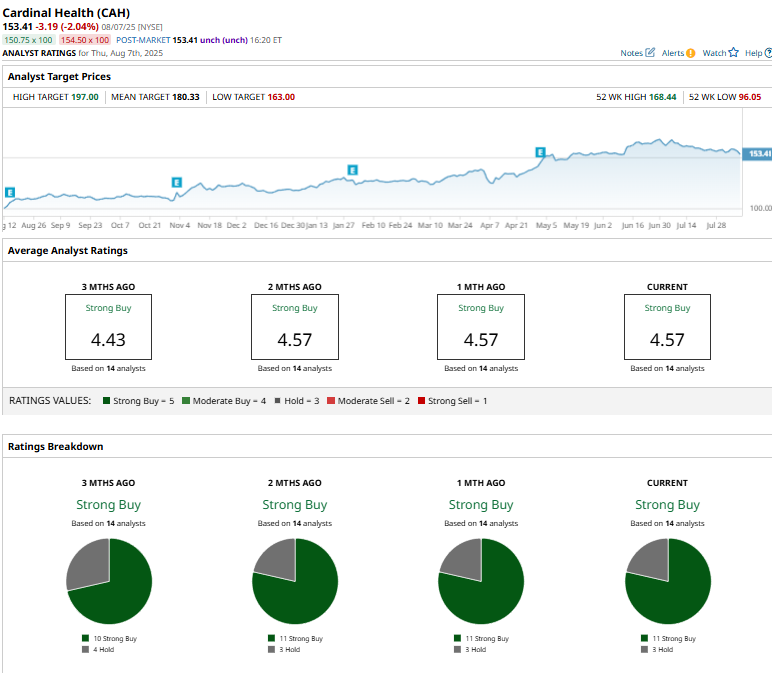

Among the 14 analysts covering the CAH stock, the consensus rating is a “Strong Buy.” That’s based on 11 “Strong Buy” and three “Hold” ratings.

This configuration is more bullish than three months ago, when the stock had 10 “Strong Buy” ratings.

On July 16, Morgan Stanley (MS) raised its price target for Cardinal Health from $181 to $190 while reiterating its “Overweight” rating, signaling continued confidence in the company’s growth prospects.

CAH’s mean price target of $180.33 suggests a 16.3% premium to current price levels, while its Street-high target of $197 indicates a 28.4% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.