Where Are Gold and Silver Prices Headed Next? The Bull and Bear Cases.

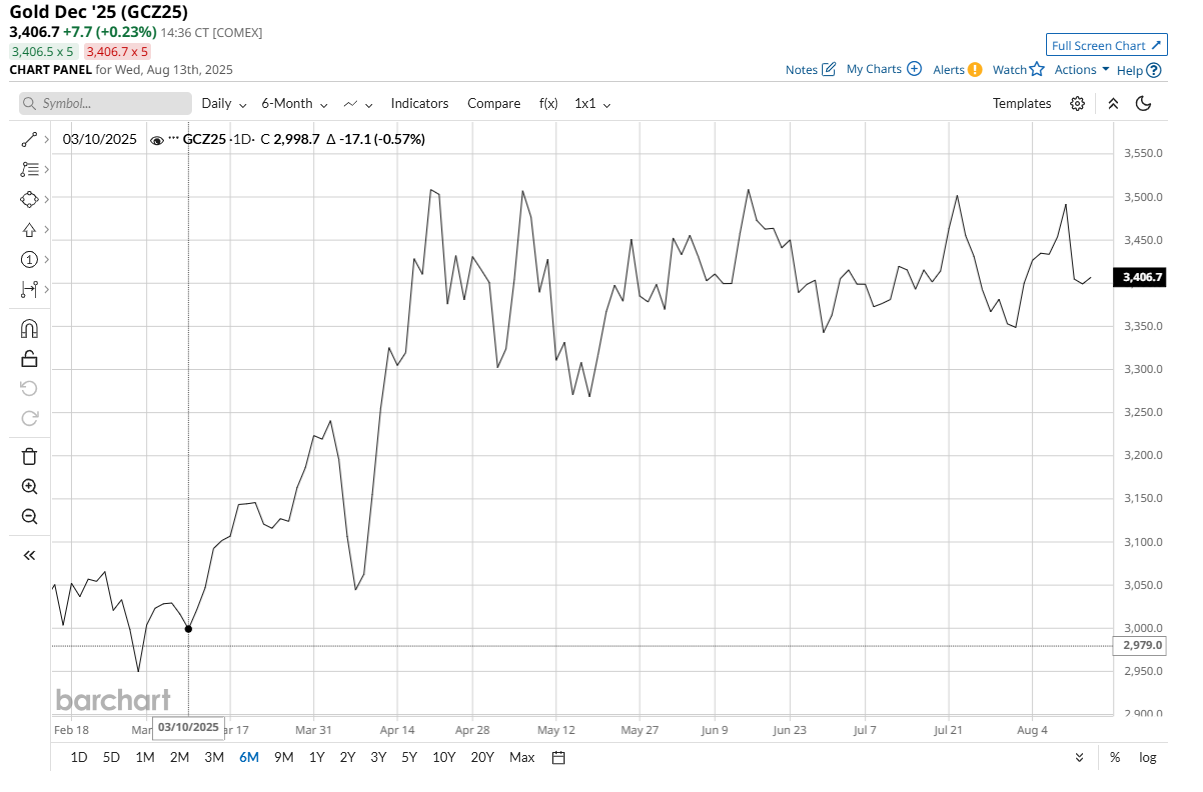

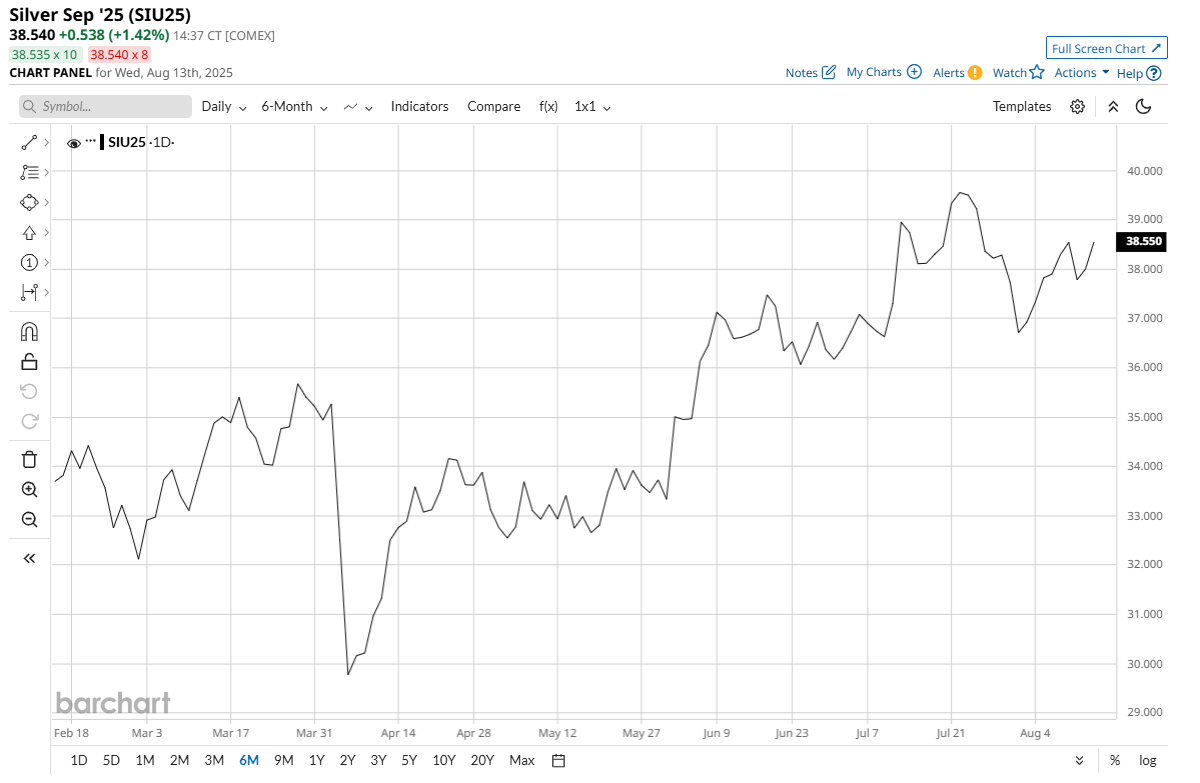

I’ve told you before that back in the 1980s when I first got into this business, one of my favorite reads regarding the market was a weekly one-page cocoa futures report that I received via snail mail. That report cut right to the chase, with no fluff. Just bullet points on bullish and bearish elements presently impacting the cocoa futures market. So here goes on my effort to replicate that report but focusing on gold (GCZ25) and silver (SIU25) markets. At the end I’ll give you my biases on price direction.

The Bull Case for Gold and Silver

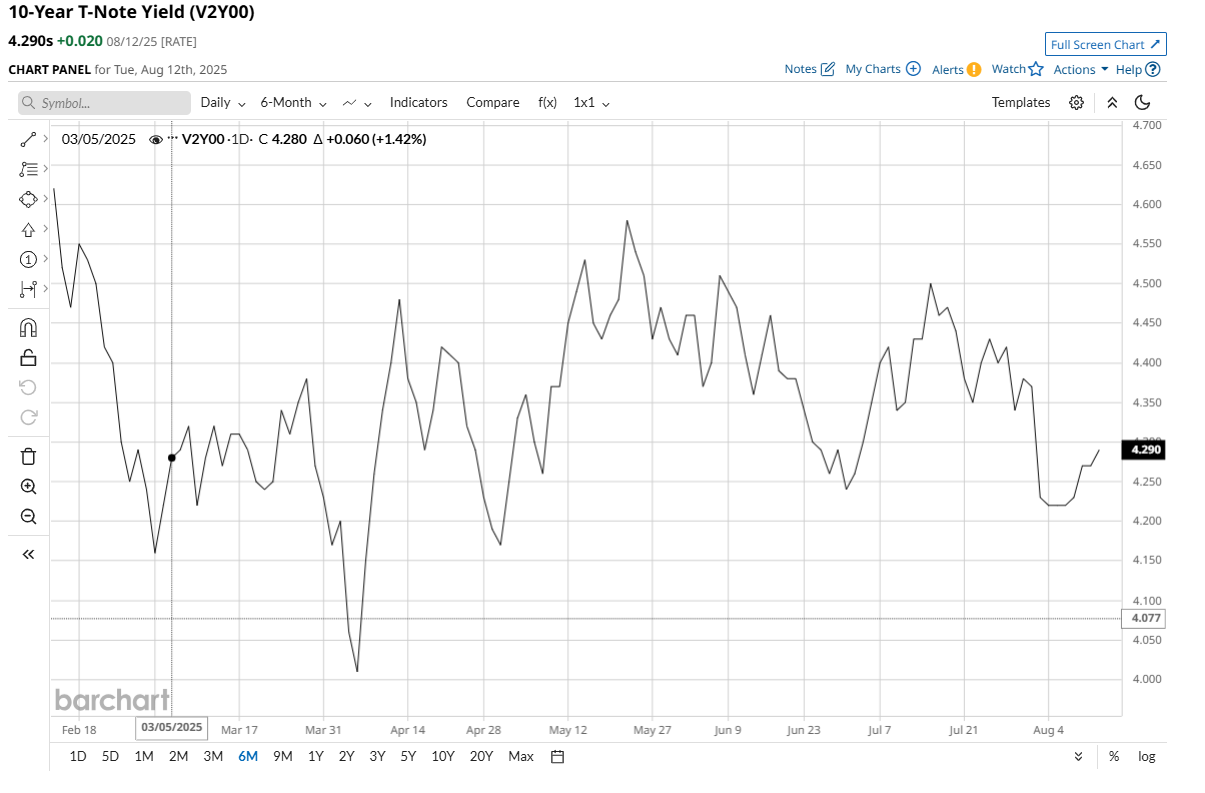

- Lower U.S. interest rates are likely coming, and lower rates are also likely to come in other major economies. That suggests better global economic growth and in turn, better consumer and commercial demand for raw commodities, including precious metals. Lower interest rates mean lower bond yields, which are also bullish for gold and silver.

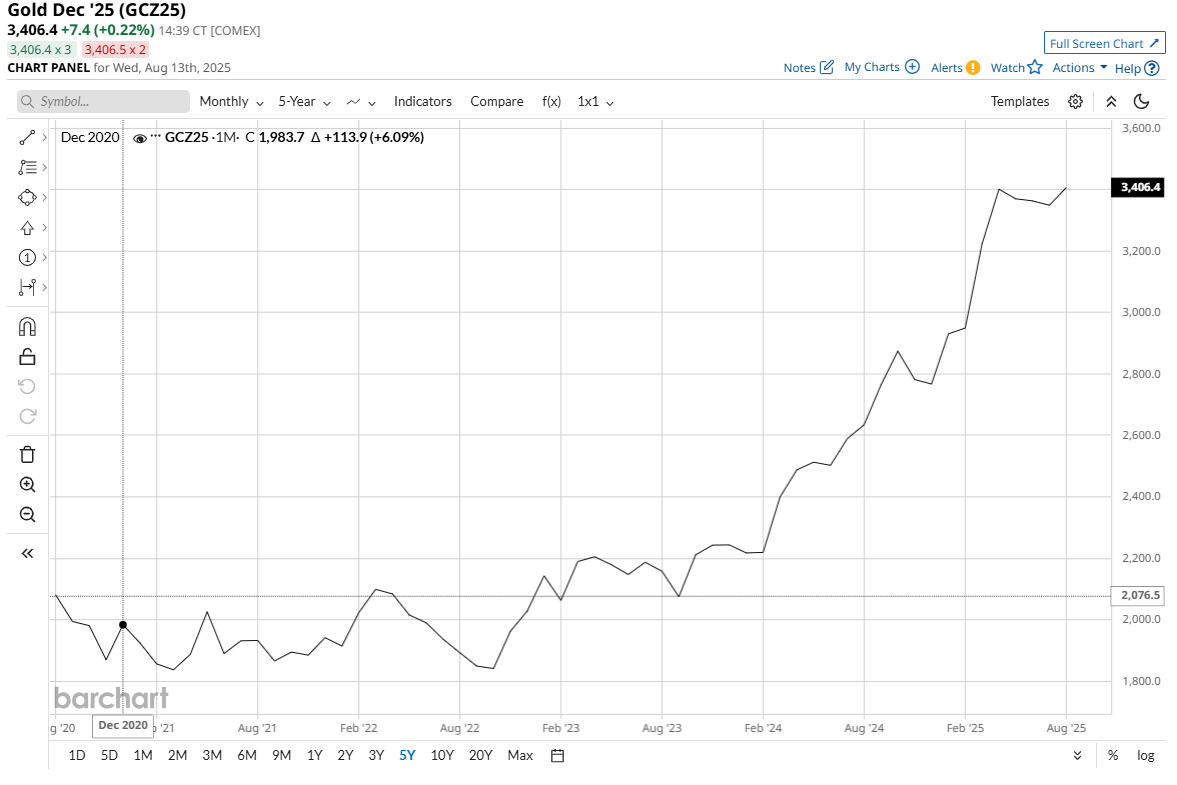

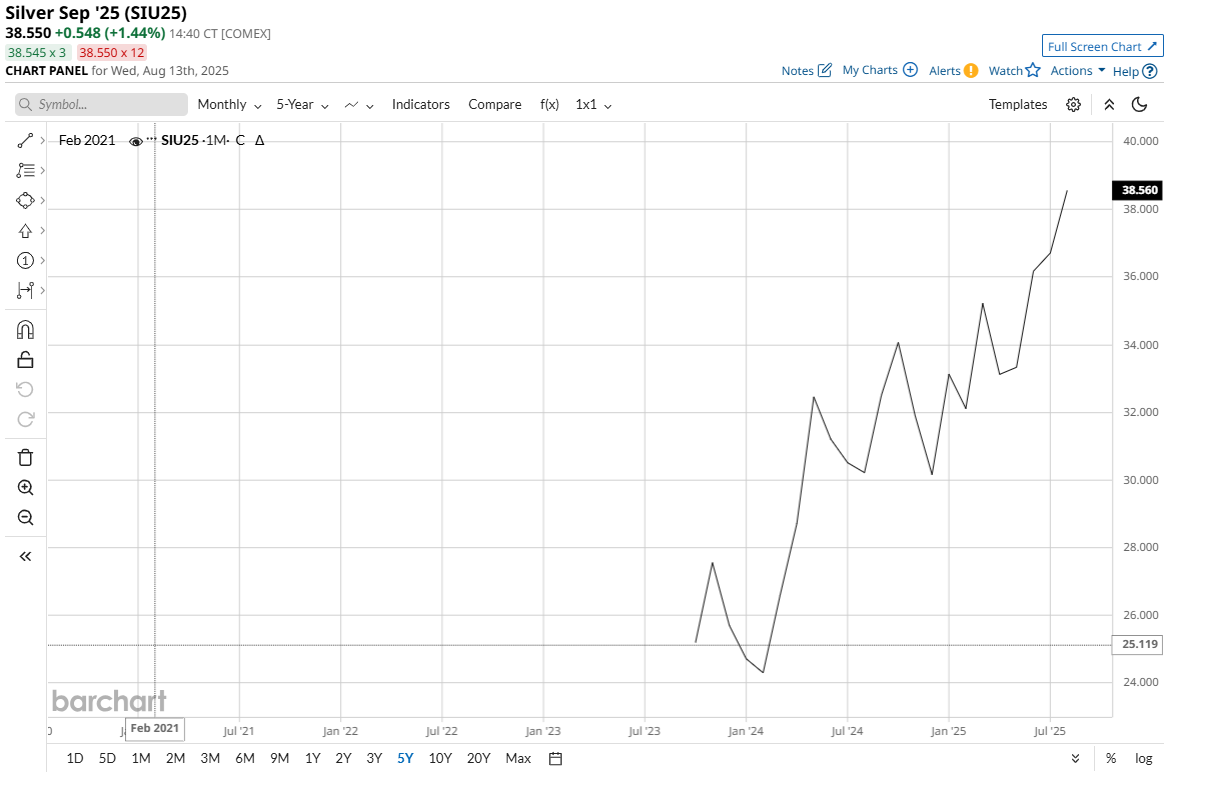

- Near-term technicals remain firmly overall bullish for both gold and silver markets. Price action recently has been sideways and choppy for both metals, but at still historically elevated levels. Longer-term charts show gold and silver still in solid price uptrends, dating back to 2016 for gold and back to 2022 for silver.

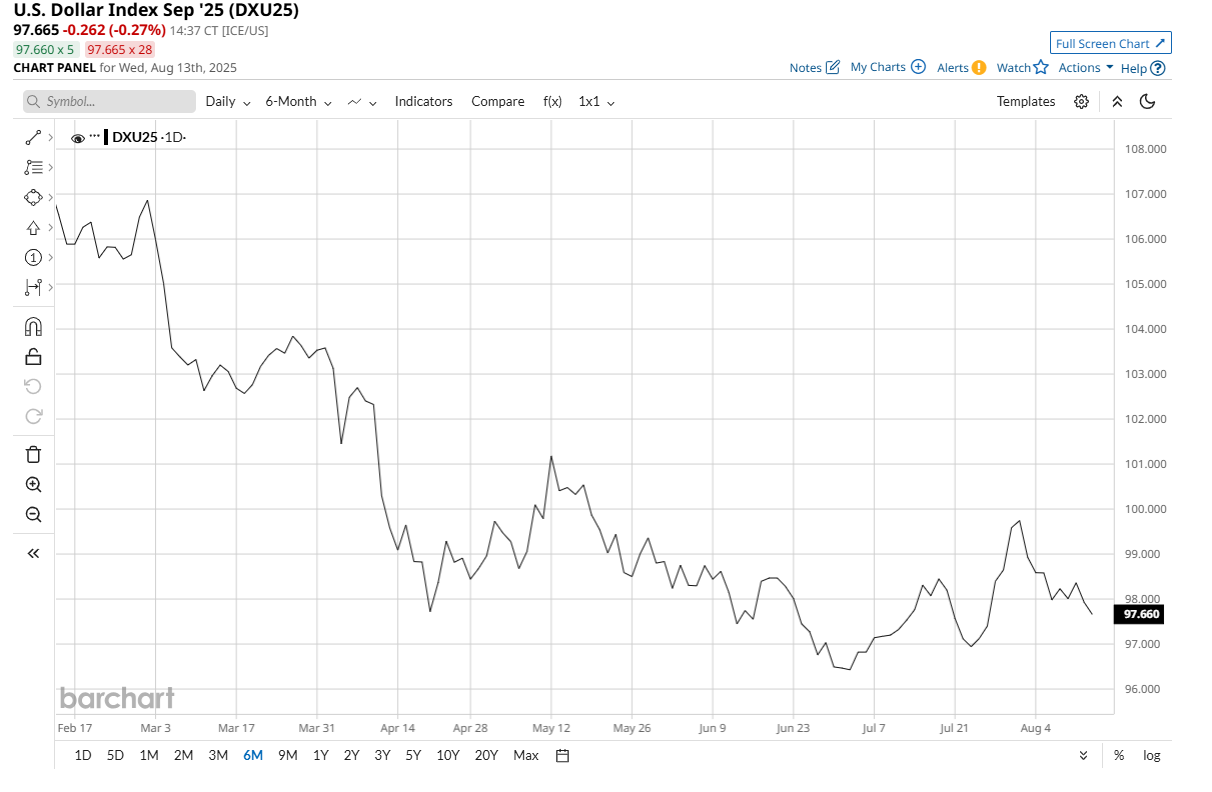

- The U.S. dollar index ($DXY) has backed down from its August high and is starting to trend down on the daily bar chart. The weakening U.S. dollar index is friendly for the metals, as the USDX is an important outside-market element for gold and silver markets’ daily price direction.

- A move by BRICS countries away from the U.S. dollar for their global financing. That’s bearish for the U.S. dollar, which is in turn friendly for the metals, as a weaker USDX is a friendly daily outside-market element for gold and silver. Also, some countries are replacing their U.S. dollar reserves in part with gold reserves.

- Geopolitical tensions are never far away from the front burner of the marketplace, and any new development that creates uncertainty would prompt keener safe-haven buying of gold and silver.

The Bear Case for Gold and Silver

- Both gold and silver are in mature, or perhaps very mature, bull market runs. The bulls may be running low on fuel to extend the price uptrends. History shows raw commodity markets are cyclical, meaning going through cycles of boom and bust. The metals are in a boom cycle now, but a bust cycle is coming. We just don’t know when.

- Gold and silver markets have seen their near-term price uptrends stall out as prices grind sideways on the daily bar charts. There are stiff overhead technical resistance levels in gold and silver, at this year’s highs, which must be overcome for the bulls to gain fresh energy to extend the price uptrends.

- New record highs scored in the major U.S. stock indexes just today are bearish for gold and silver, from a competing asset class perspective.

- There are early clues the U.S. dollar index has bottomed out. If the greenback starts an upward climb in the coming weeks or months, that would be a bearish weight on the precious metals.

- The geopolitical scene is relatively quiet at present, compared to the recent past. That’s negative for the safe-haven metals.

Where Are Gold and Silver Prices Heading? Here’s My Bottom Line.

My bias is that gold and silver prices will continue to grind sideways, and possibly higher, in the coming weeks and months. Technicals remain firmly bullish overall and global interest rates are starting to decline. A major and unexpected geopolitical event would spike gold and silver to record highs in a hurry.

I’ll bet I’ve missed some bullet points. Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.