This Turnaround Stock Has Tripled from Its 52-Week Lows: Is It Still a Buy?

While corporate turnarounds are somewhat of a cliche, there are genuine turnaround stories to be found. One of them is fitness equipment and subscription company Peloton (PTON), which, like other pandemic-era winners, had to reboot its business strategy.

While the stock trades at a tiny fraction of its all-time highs, it has more than tripled from its 52-week lows that it hit last year. In this article, we’ll examine whether there’s still heat left in PTON’s rally that has helped it recoup its 2025 losses and nearly turn positive for the year.

Peloton Is a Turnaround Play

To begin with, let’s look at the progress in Peloton’s turnaround, which began in February 2022 when Barry McCarthy – the former Netflix (NFLX) and Spotify (SPOT) executive – took over as CEO, replacing the company’s co-founder, John Foley. He embarked on an aggressive cost-cutting program, including through layoffs, and Peloton pivoted to third-party production to reduce fixed costs.

While these measures help Peloton trim losses and turn free cash flow positive, PTON shares continued to dwindle and fell to record lows last year. In October 2024, Peloton announced Apple Fitness+ (AAPL) co-founder Peter Stern as its next CEO. Stern took over in early 2025 and is now leading the next leg of Peloton’s turnaround, which includes turning around the corner on top-line growth.

PTON’s Revenues Have Fallen

Peloton’s revenues have fallen for four consecutive years, and its sales in fiscal 2025, which ended in June, were just about 62% of fiscal year 2021 levels. The midpoint of its guidance implies a 2% year-over-year fall in this year’s revenues, also. There is, however, a silver lining here as the top end of the guidance implies a yearly rise in revenues. Also, even the midpoint of the guidance implies some growth in the final three quarters of this fiscal year, as the company expects revenues to fall 9% at the midpoint in the current quarter.

Peloton has taken several measures to boost its sales. These include promotional pricing for different groups, the launch of micro stores to improve brand visibility, and the launch of Peloton Repowered, its platform for buying and selling used equipment.

Peloton Has Turned Free Cash Flow Positive

One of the concerns for Peloton investors was the company’s losses and cash burn. PTON has been working on aggressive cost cuts, and after achieving run-rate savings of $200 million in fiscal 2025, it is targeting another $100 million worth of savings in the current fiscal year.

In FY 2025 it generated healthy free cash flows of $323.7 million, which were ahead of its guidance. The company expects net working capital and restructuring charges to be a headwind for its free cash flows this year, while forecasting a tariff impact of $65 million. Despite these challenges, it has forecast free cash flows above $200 million this year, which is quite encouraging.

Peloton has been using its free cash flows to pare its debt and ended June with net debt of $459 million, 43% lower than the corresponding period last year. As Peloton’s balance sheet continues to improve and interest rates come down, the company should be able to refinance its debt at much better terms than what they are currently.

Peloton Stock Forecast

Analysts have gradually turned bullish on Peloton as the company has shown impressive progress in its turnaround. Over the last two weeks only, UBS and Goldman Sachs have upgraded the stock from a “Neutral” to “Buy.”

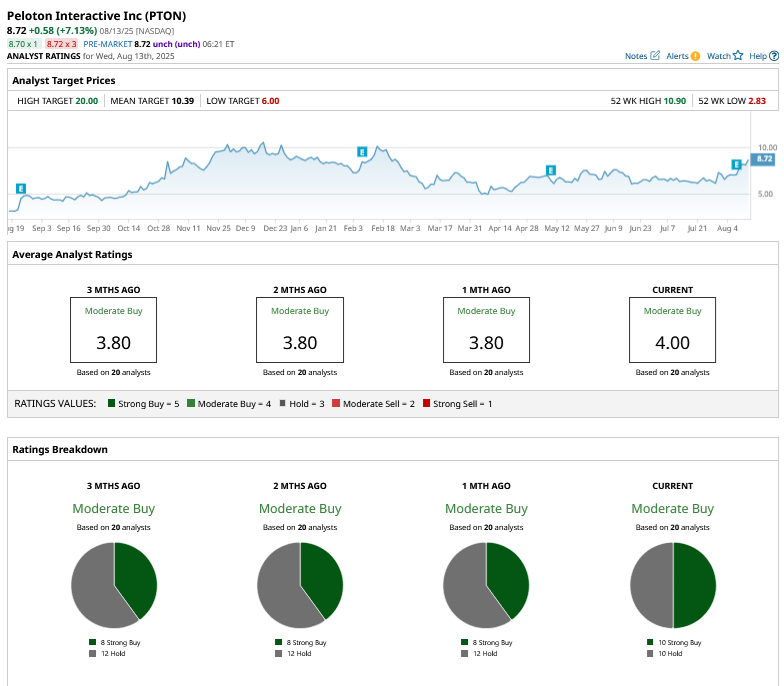

Of the 20 analysts rating PTON, 10 each rate it as a “Moderate Buy” and “Hold” while its mean target price of $10.39 is 19% higher than the Aug. 13 closing price.

Peloton stock trades at a forward price-sales multiple of 1.45x while the enterprise value-to-earnings before interest, tax, depreciation, and amortization (EV-to-EBITDA) multiple is 10.4x. The multiples are not too demanding considering the current mix of Peloton’s business, where around two-thirds of its revenues come from subscriptions, with volatile product sales accounting for the rest.

I believe there is still heat left in Peloton’s rally as it strives to become a broad-based wellness partner for its members, including mental well-being, sleep, and nutrition. The turnaround has been going at a steady pace, and the stock could reward shareholders even further if the company can return to top-line growth while continuing to improve its margins and cash flows.

On the date of publication, Mohit Oberoi had a position in: PTON , AAPL , NFLX . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.