Eaton Stock: Is Wall Street Bullish or Bearish?

/Eaton%20Corporation%20plc%20site-by%20chrisdorney%20via%20Shutterstock.jpg)

Eaton Corporation plc (ETN), headquartered in Dublin, Ireland, is a global power management company. Valued at a market cap of $136.7 billion, Eaton operates in over 175 countries through its five main segments: Electrical Americas, Electrical Global, Aerospace, Vehicle, and eMobility.

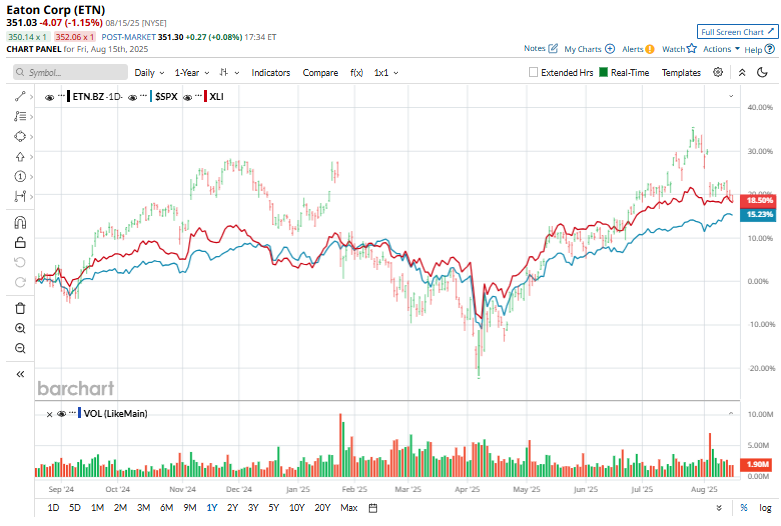

ETN shares have slightly trailed the broader market over the past 52 weeks. ETN has surged 16.1% over this time frame, while the broader S&P 500 Index ($SPX) has soared 16.4%. Moreover, the stock is up 5.8% on a YTD basis, compared to SPX’s 9.7% rise during the same time frame.

Zooming in further, Eaton has also lagged behind the Industrial Select Sector SPDR Fund’s (XLI) 18.3% return over the past 52 weeks and a 14.2% gain on a YTD basis.

On August 5, Eaton delivered record-breaking second-quarter results, with adjusted EPS soaring to $2.95, an 8% increase and a new quarterly high. Sales hit a record $7 billion, marking an 11% rise from Q2 2024, driven by 8% organic growth. Cash flow remained robust, with $918 million in operating cash flow and $716 million in free cash flow. Eaton highlighted strong order activity and backlog growth, in particular, 15% backlog growth in Electrical and 16% in Aerospace, with a book-to-bill ratio of 1.1 across the combined Electrical and Aerospace segments.

However, the company lowered its annual profit forecast, and weakness in its Vehicle and eMobility segments further weighed on investor sentiment, sending its shares down about 7.4%.

For the current fiscal year, ending in December, analysts expect Eaton's EPS to grow 11.7% year over year to $12.06. The company’s earnings surprise history is promising. It surpassed the Wall Street estimates in each of the last four quarters.

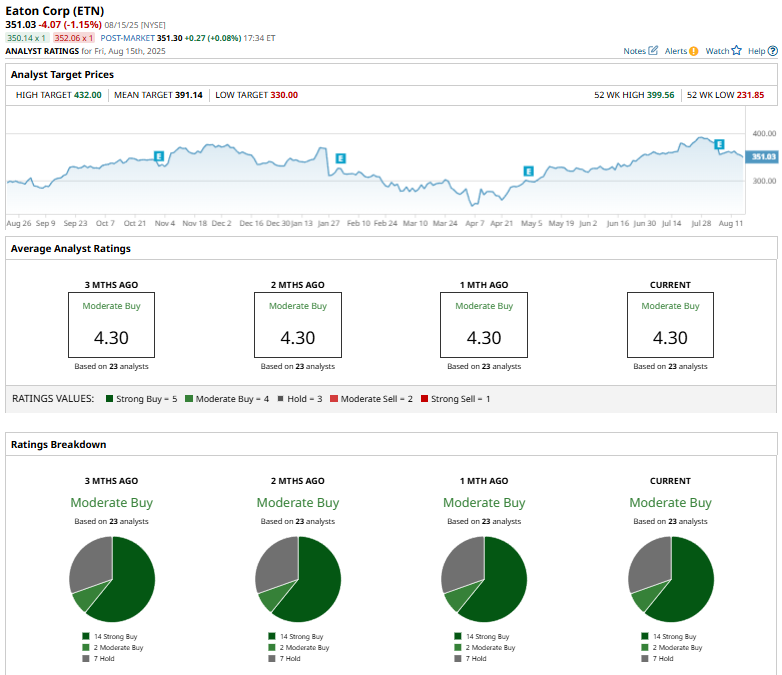

Among the 23 analysts covering the stock, the consensus rating is a “Moderate Buy,” which is based on 14 “Strong Buy,” two “Moderate Buy,” and seven “Hold” ratings.

On August 7, 2025, Raymond James analyst Tim Thein reaffirmed an “Outperform” rating on Eaton and raised the price target from $380 to $415, marking a 9.21% increase and signaling confidence in the company’s growth outlook.

The mean price target of $391.14 represents a 11.4% premium from Eaton’s current price levels, and the Street-high price target of $432 suggests an upside potential of 23.1%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.