Archer Aviation Stock Is Soaring on New FAA Win. Should You Buy ACHR Here?

Archer Aviation (ACHR) stock surged following the Federal Aviation Administration's (FAA) announcement of its eVTOL Integration Pilot Program, a key milestone for the electric air taxi industry. The program will be the first federal initiative designed to accelerate real-world electric vertical takeoff and landing (eVTOL) aircraft operations in the United States.

The FAA's framework enables cities nationwide to participate alongside manufacturers like Archer, as well as airlines such as United Airlines (UAL), in supervised trial operations ahead of full certification. These trials could begin in early 2026, demonstrating that eVTOL operations are safe, quiet, and scalable, critical factors for community acceptance and regulatory approval.

Archer's participation builds on its existing partnership with United Airlines, which invested in the company back in 2021. The trials will focus on the Midnight aircraft, designed to revolutionize urban transportation by offering emission-free alternatives to traditional ground transport while reducing traffic congestion.

While the pilot program accelerates development timelines, Archer faces hurdles that include obtaining FAA certification, scaling up manufacturing, and proving commercial viability. The eVTOL industry is in its early stages, with most companies still in the pre-revenue phase.

Is Archer Aviation Stock a Good Buy Right Now?

Archer Aviation continues to demonstrate progress toward commercial air taxi deployment in 2025. The electric vertical takeoff and landing aircraft manufacturer also ended Q2 with $1.7 billion in liquidity while advancing critical certification milestones.

Archer's Midnight aircraft completed its longest piloted flight to date, covering 55 miles in 31 minutes at speeds exceeding 126 mph. The conventional takeoff and landing mission, witnessed by United Airlines CFO Mike Leskinen, indicates the aircraft's operational readiness and performance consistency. Four test pilots now regularly conduct Midnight flights, indicating program maturity as the company approaches FAA certification.

The company is concurrently producing six Midnight aircraft across facilities in California and Georgia, with three in final assembly. This manufacturing ramp utilizes Archer's "golden line" approach, where processes are refined in Silicon Valley before being scaled up at the high-volume Georgia facility.

The FAA continues to conduct production certificate reviews, which align certification progress with manufacturing readiness. Archer's selection as the official air taxi provider for the 2028 LA Olympics provides a definitive commercialization target, backed by federal support through presidential executive orders promoting American eVTOL leadership. The UAE Launch Edition program has begun to generate revenue through definitive agreements with Abu Dhabi Aviation, with initial payments expected this year.

Two strategic acquisitions in Q2 accelerated Archer's defense capabilities, as it acquired patent portfolios from Overair and manufacturing assets from Mission Critical Composites. With the Pentagon requesting $13.4 billion for autonomous military systems, the defense opportunity represents significant long-term potential.

What Is the Target Price for ACHR Stock?

Analysts tracking ACHR stock expect sales to rise from $1.42 million in 2025 to $1.78 billion in 2029. Comparatively, it is forecast to end 2029 with adjusted earnings per share of $0.21, compared to a loss per share of $0.78 in 2025.

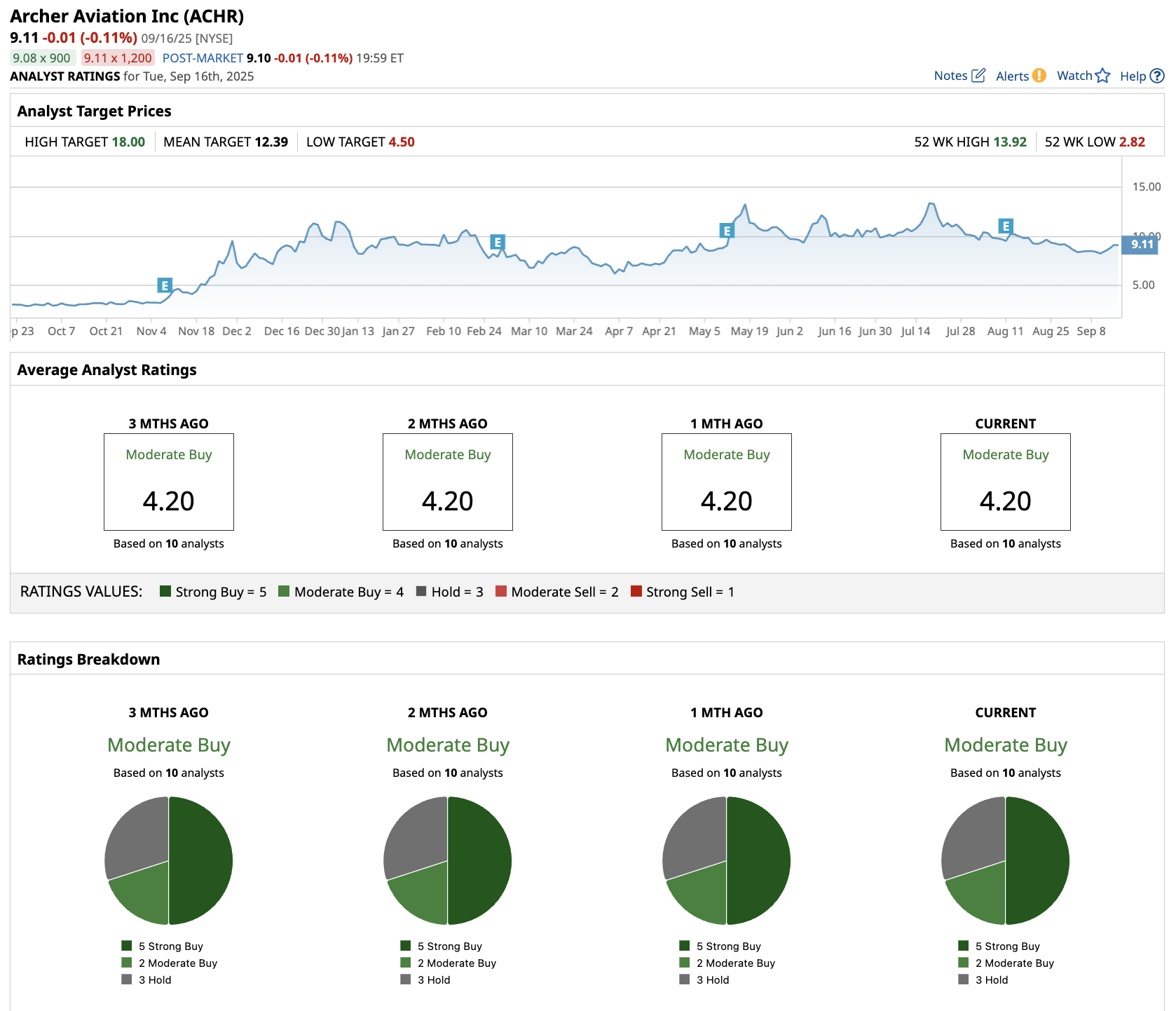

Out of the 10 analysts covering, five recommend “Strong Buy,” two recommend “Moderate Buy,” and three recommend “Hold.” The average 12-month ACHR stock price target is $12.39, above the current price of $9.11.

While operational progress remains encouraging, ACHR stock investors should recognize the extended certification timeline and capital intensity required for full commercialization. The company's liquidity provides an adequate runway, but a focus on execution and market development will ultimately determine its long-term viability in this emerging sector.

ACHR stock is up 183% over the last year, but it also trades 36% below its all-time high. Conservative investors may prefer waiting for clearer regulatory pathways and operational milestones. In contrast, growth-oriented investors might view current levels as an entry point into what could become a revolutionary transportation sector.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.